The 2026 SIMPLE IRA contribution limits bring important updates for employees and small business owners saving for retirement. Starting January 1, 2026, new limits apply under federal retirement rules shaped by recent legislation, including enhanced catch-up provisions for certain age groups. SIMPLE IRAs remain a popular retirement plan for small employers because of their low administrative cost and straightforward structure. In 2026, the standard employee deferral limit increases compared to prior years, and special higher catch-up limits apply for workers aged 60 to 63. These limits are set and adjusted by federal authorities based on inflation and retirement policy goals, impacting millions of workers enrolled in SIMPLE IRA plans across the United States.

2026 SIMPLE IRA Contribution Limits

For employees, higher limits mean more opportunities to save tax-deferred income. For employers, understanding these changes is essential to remain compliant and to communicate benefits accurately to staff.

This article explains the 2026 SIMPLE IRA contribution limits in clear language, covering employee deferrals, employer contributions, catch-up rules, and who benefits most from the 2026 updates.

What Is a SIMPLE IRA and Who Uses It?

A SIMPLE IRA is a retirement plan designed for small businesses, typically those with 100 or fewer employees. It allows employees to contribute a portion of their salary while requiring employers to make contributions as well. These plans are widely used because they are easier to manage than traditional 401(k) plans.

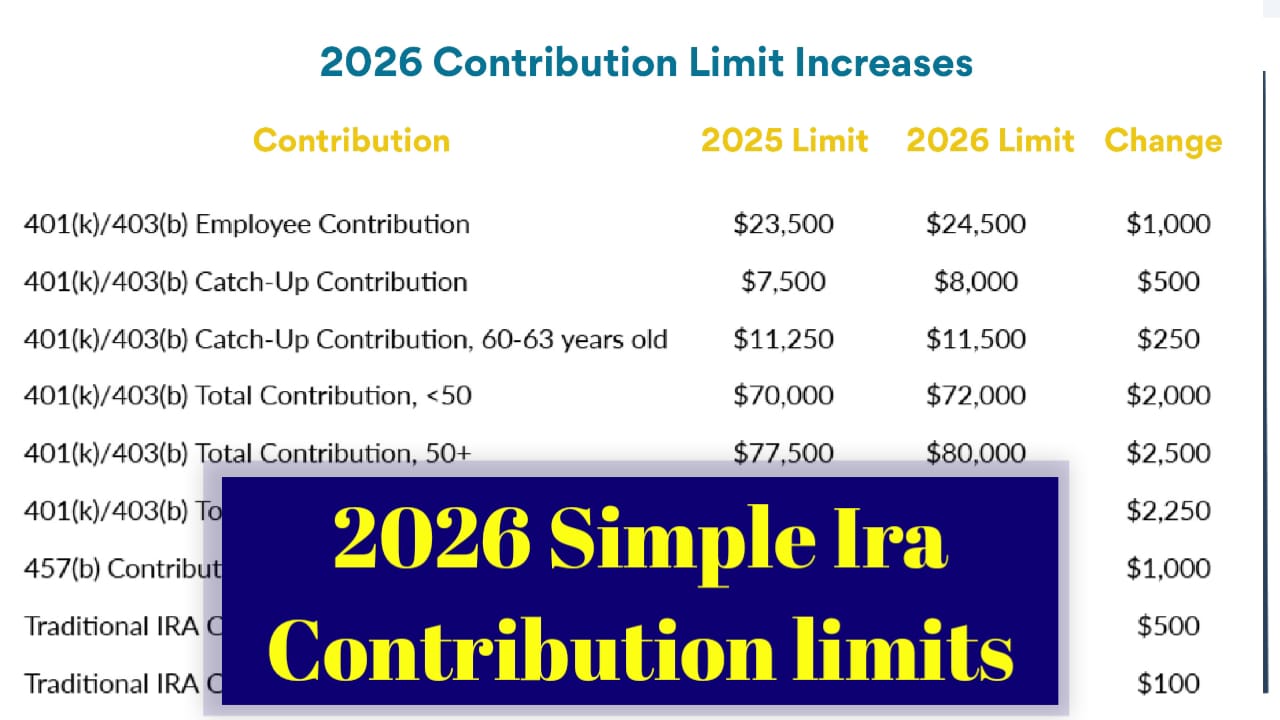

2026 SIMPLE IRA Contribution Limits Overview

For 2026, contribution limits reflect inflation adjustments and changes introduced under recent retirement legislation. Both employees and employers must follow these updated caps.

2026 SIMPLE IRA Contribution Limits Table

| Category | 2025 Limit | 2026 Limit | Age Group | Applies To | Contribution Type | Tax Treatment | Notes |

|---|---|---|---|---|---|---|---|

| Employee Deferral | $16,000 | $16,500 | All eligible | Employees | Salary deferral | Pre-tax | Standard limit |

| Catch-Up Contribution | $3,500 | $3,500 | Age 50+ | Employees | Catch-up | Pre-tax | No change |

| Enhanced Catch-Up | Not available | $5,000 | Ages 60–63 | Employees | Special catch-up | Pre-tax | New rule |

| Employer Match (Max %) | 3% | 3% | All ages | Employers | Matching | Deductible | Optional match |

| Employer Nonelective | 2% | 2% | All ages | Employers | Fixed contribution | Deductible | Alternative option |

| Total Potential (50+) | $19,500 | $20,000 | Age 50+ | Employees | Combined | Tax-deferred | Includes catch-up |

| Total Potential (60–63) | N/A | $21,500 | Ages 60–63 | Employees | Combined | Tax-deferred | Highest allowed |

| Eligibility Threshold | Same | Same | All ages | Employees | Plan access | N/A | Employer defined |

READ ALSO-

Standard Employee Contribution Limit for 2026

The standard employee salary deferral limit increases to $16,500 in 2026. This amount applies to all eligible workers participating in a SIMPLE IRA plan, regardless of age, before any catch-up contributions.

SIMPLE IRA Catch-Up Contributions in 2026

Catch-up contributions allow older workers to save more as they approach retirement. In 2026, the traditional catch-up limit for employees aged 50 and older remains unchanged at $3,500.

What’s new is the enhanced catch-up rule:

- Employees aged 60 to 63 can contribute up to $5,000 extra

- This higher limit is designed to boost late-career retirement savings

Employer Contribution Rules for SIMPLE IRAs

Employers must choose one of two contribution methods each year. They can either match employee contributions dollar-for-dollar up to 3% of compensation or make a fixed 2% nonelective contribution for all eligible employees, even those who do not contribute.

How the 2026 SIMPLE IRA Limits Affect Employees

Higher contribution limits mean employees can reduce taxable income while building a larger retirement balance. Workers aged 60 to 63 benefit the most in 2026 due to the enhanced catch-up allowance.

Compliance and Planning for Employers in 2026

Employers must update payroll systems and plan communications to reflect the new 2026 SIMPLE IRA contribution limits. Clear communication helps employees take full advantage of the available savings opportunities.

Why the 2026 SIMPLE IRA Changes Matter

The updated limits align with broader retirement policy goals, encouraging higher savings rates and offering additional flexibility for older workers. These changes make SIMPLE IRAs more competitive with other retirement plans.

FAQs

Q1. What is the employee SIMPLE IRA contribution limit for 2026?

The standard limit is $16,500, excluding any catch-up contributions.

Q2. Who qualifies for the enhanced catch-up contribution in 2026?

Employees aged 60 to 63 qualify for the higher $5,000 catch-up limit.

Q3. Are employers required to increase their contributions in 2026?

No, employer contribution percentages remain unchanged.

| Simple IRA Contribution Link | Click Here |