The HSA Contribution Limits 2026 have been officially updated, giving individuals and families new opportunities to save more for healthcare while enjoying powerful tax advantages. For the 2026 tax year, the Internal Revenue Service announced higher annual contribution limits for Health Savings Accounts, reflecting ongoing inflation adjustments. Individuals with self-only high-deductible health plans can now contribute up to $4,450, while those with family coverage may contribute up to $8,900. The additional $1,000 catch-up contribution remains available for people aged 55 and older. Contributions apply to the full 2026 calendar year, with the contribution deadline falling on the standard tax filing date in 2027. Updates are issued annually by the IRS through its official guidance.

HSA Contribution Limits 2026

Health Savings Accounts continue to be one of the most tax-efficient tools for managing healthcare costs. Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are not taxed. With rising medical expenses, understanding the HSA contribution limits 2026 is essential for effective financial and health planning.

The 2026 updates are especially important for households aiming to maximize tax savings while preparing for both short-term medical needs and long-term healthcare expenses. Whether you are enrolled through an employer or managing an individual plan, staying informed helps you make better financial decisions.

What Is an HSA and Why It Matters in 2026

A Health Savings Account (HSA) is a tax-advantaged account available to individuals enrolled in a qualified high-deductible health plan. HSAs allow you to set aside money specifically for healthcare expenses while reducing taxable income.

In 2026, HSAs remain valuable not only for covering current medical costs but also as a long-term savings tool. Funds roll over year to year and can be invested, making HSAs increasingly popular among individuals focused on retirement healthcare planning.

HSA Contribution Limits 2026: Official IRS Amounts

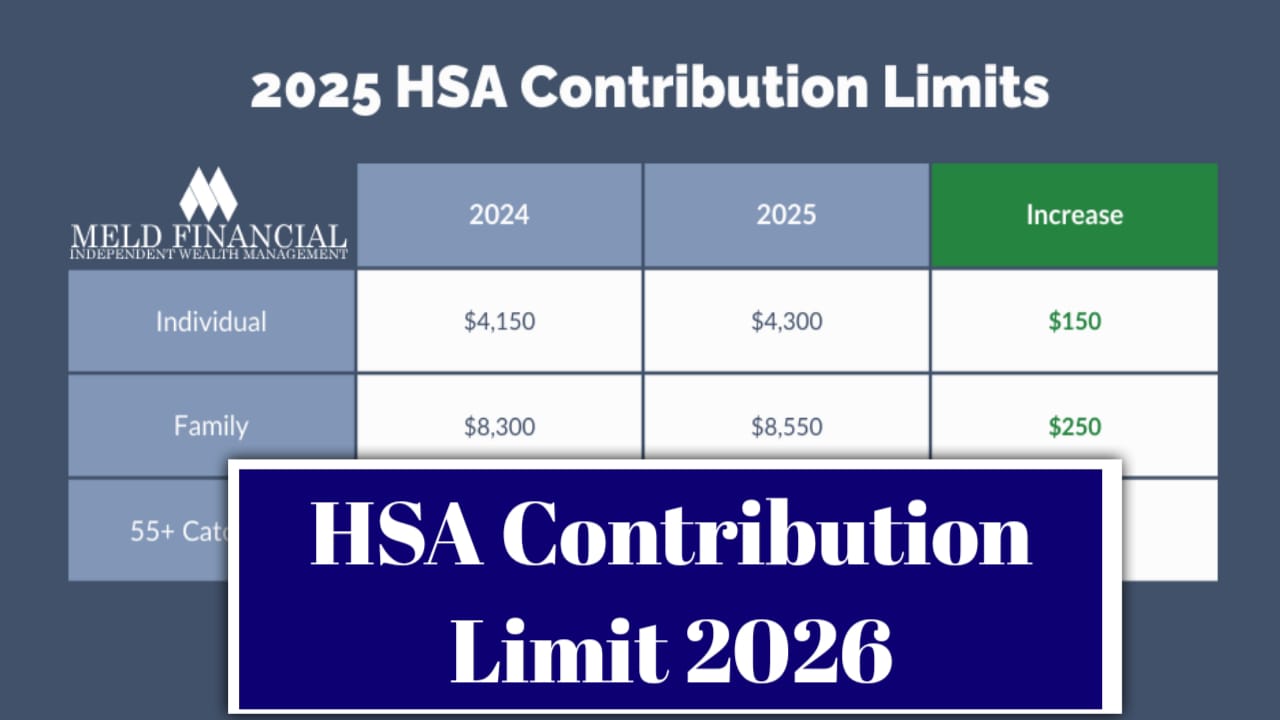

The IRS reviews HSA limits annually to account for inflation. The 2026 HSA contribution limits represent a noticeable increase compared to previous years.

HSA Contribution Limits 2026 Overview

| Category | 2026 Limit |

|---|---|

| Self-Only Coverage | $4,450 |

| Family Coverage | $8,900 |

| Catch-Up Contribution (55+) | $1,000 |

| Maximum Total (Family + Catch-Up) | $9,900 |

| Contribution Year | Calendar Year 2026 |

| Contribution Deadline | Tax Filing Date 2027 |

| Employer + Employee Combined | Yes |

| Rollover Allowed | Yes |

These limits apply to the combined total of employer and employee contributions.

READ ALSO-

Who Is Eligible to Contribute to an HSA in 2026

To contribute to an HSA in 2026, you must meet specific eligibility requirements. You must be enrolled in a qualifying high-deductible health plan and cannot be covered by other disqualifying health coverage.

Eligibility is determined on a monthly basis, meaning partial-year contributions may apply if coverage changes during the year.

High-Deductible Health Plan Requirements for 2026

For 2026, IRS rules define minimum deductible and maximum out-of-pocket thresholds that a health plan must meet to qualify as HSA-eligible. These thresholds ensure that HSAs remain tied to consumer-driven healthcare plans.

Understanding these requirements helps avoid excess contributions, which may result in penalties if not corrected in time.

How to Maximize Your HSA Contributions in 2026

Making the most of the HSA contribution limits 2026 requires planning and consistency.

- Contribute gradually through payroll deductions to stay within limits

- Invest unused HSA funds to grow savings for future medical needs

Strategic contributions can significantly reduce taxable income while building a healthcare safety net.

Common HSA Contribution Mistakes to Avoid

Many account holders accidentally exceed limits or misunderstand eligibility rules. Employer contributions are often overlooked, leading to excess funding.

Another common error is contributing while enrolled in non-qualified coverage. Monitoring your plan status throughout the year helps prevent costly mistakes.

Frequently Asked Questions (FAQs)

What is the HSA contribution limit for individuals in 2026?

The self-only HSA contribution limit for 2026 is $4,450.

Can I contribute to an HSA after age 65?

You can keep and use HSA funds, but new contributions stop once enrolled in Medicare.

Does unused HSA money expire?

No, all unused HSA funds roll over and remain available year after year.

Conclusion

The HSA Contribution Limits 2026 provide individuals and families with an expanded opportunity to save for healthcare while benefiting from powerful tax advantages. With higher limits, continued rollover flexibility, and long-term investment potential, HSAs remain one of the most effective financial tools available. By understanding the updated rules and planning contributions carefully, you can maximize savings, reduce tax liability, and stay prepared for future medical expenses.

| HSA Contribution | Click Here |

| HSA Contribution Link | Click Here |