The federal mileage rate 2026 has been officially set and will apply to miles driven starting January 1, 2026. Each year, the Internal Revenue Service announces updated mileage rates to reflect rising or falling costs related to fuel, maintenance, insurance, and vehicle depreciation. For 2026, the standard business mileage rate has increased to 72.5 cents per mile, marking a noticeable adjustment compared to 2025. These rates are used nationwide by self-employed individuals, businesses, and eligible taxpayers to calculate vehicle-related deductions and reimbursements. Millions of Americans rely on the federal mileage rate annually to reduce taxable income and accurately account for work-related driving expenses.

Federal Mileage Rate 2026

Mileage rates are more than just numbers. They directly affect tax planning, reimbursement policies, and budgeting for anyone who uses a personal vehicle for work, medical travel, or charitable activities.

This article explains the federal mileage rate 2026 in simple terms, covering updated rates, who qualifies, how deductions work, and why these changes matter in the current economic environment.

What Is the Federal Mileage Rate?

The federal mileage rate is a standardized per-mile amount that taxpayers can use instead of calculating actual vehicle expenses. It simplifies tax reporting by combining fuel, repairs, insurance, registration, and depreciation into one rate.

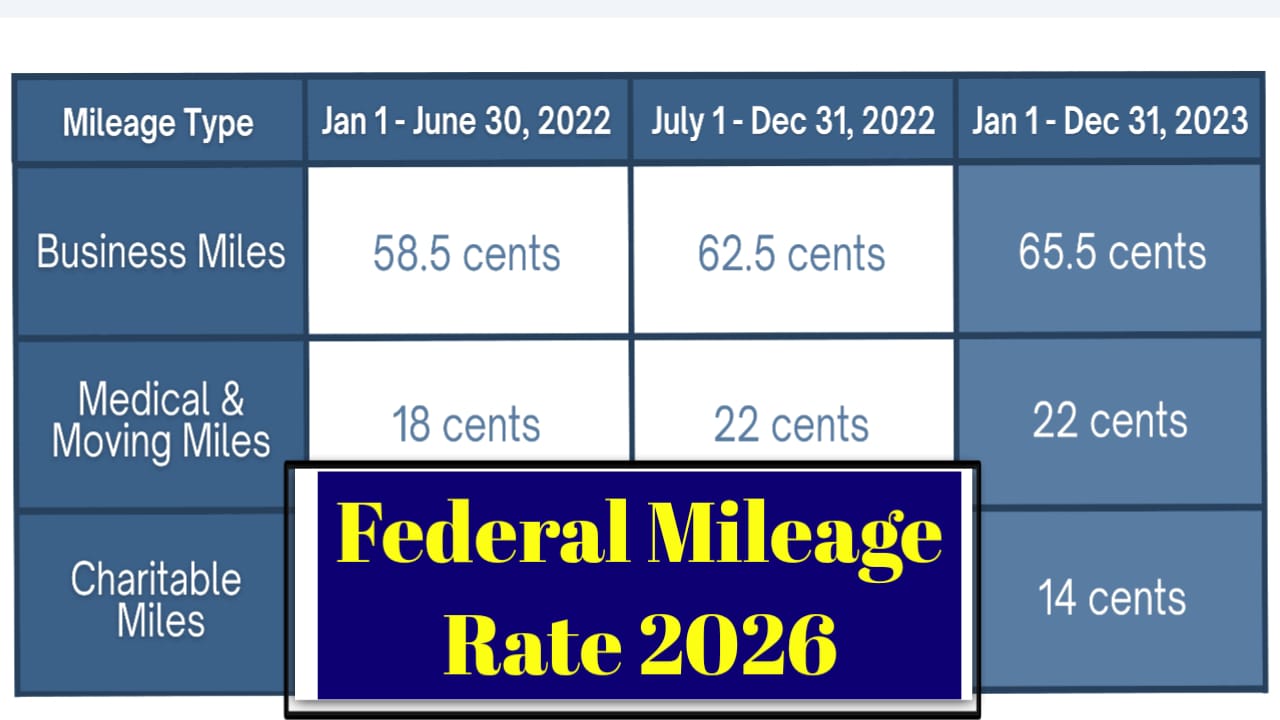

Federal Mileage Rate 2026: Official Rates Overview

The table below outlines all federally approved mileage rates for 2026, based on the latest IRS announcement.

Federal Mileage Rate 2026 Table

| Mileage Category | 2025 Rate | 2026 Rate | Change | Who Can Claim | Purpose | Tax Deductible | Notes |

|---|---|---|---|---|---|---|---|

| Business Use | 70.0 cents | 72.5 cents | +2.5 cents | Self-employed, businesses | Work travel | Yes | Most used rate |

| Medical Travel | 22 cents | 22 cents | No change | Individuals | Healthcare travel | Yes | Limited use |

| Moving (Military) | 22 cents | 22 cents | No change | Active-duty military | Relocation | Yes | Qualified moves only |

| Charitable Use | 14 cents | 14 cents | No change | Volunteers | Charity service | Yes | Fixed by law |

| Depreciation Portion | Included | Included | Adjusted | Business users | Vehicle wear | Partial | Built into rate |

| Fuel Cost Factor | Variable | Higher | Increase | All users | Gas expenses | Included | Reflects prices |

| Maintenance Costs | Variable | Higher | Increase | All users | Repairs | Included | Inflation-based |

| Inflation Adjustment | Annual | Applied | Yes | All users | Cost of living | Included | Automatic update |

READ ALSO-

Business Federal Mileage Rate Increase in 2026

The most significant change to the federal mileage rate 2026 is the increase in the business rate to 72.5 cents per mile. This adjustment reflects higher operating costs, including fuel prices and vehicle maintenance. For frequent business drivers, this increase can result in meaningful tax savings.

Medical and Moving Mileage Rate for 2026

The mileage rate for medical travel and qualifying military moves remains unchanged at 22 cents per mile. While this rate is lower than the business rate, it still provides valuable tax relief for eligible taxpayers.

Charitable Mileage Rate Stays Fixed

The charitable mileage rate continues at 14 cents per mile in 2026. Unlike other rates, it does not change annually because it is set by federal law.

- Applies only to volunteer service for qualified organizations

- Accurate mileage records are still required

Who Can Use the Federal Mileage Rate 2026?

The standard mileage method is available to self-employed individuals, independent contractors, small business owners, and certain employees with unreimbursed expenses. Eligibility depends on how the vehicle is used and whether tax rules are met.

Standard Mileage vs Actual Expense Method

Taxpayers can choose between the standard mileage rate and the actual expense method. The standard method is simpler, while the actual expense method may benefit those with high vehicle costs.

- Standard mileage offers simplicity and consistency

- Actual expenses require detailed recordkeeping

Recordkeeping Requirements for Mileage Claims

To claim deductions using the federal mileage rate, drivers must keep accurate logs. This includes dates, miles driven, travel purpose, and start and end locations. Without proper documentation, deductions may be denied.

Why the Federal Mileage Rate 2026 Matters

The federal mileage rate 2026 plays a crucial role in helping taxpayers offset rising transportation costs. With inflation still affecting fuel and maintenance prices, the higher business rate provides more realistic reimbursement and deduction opportunities for drivers nationwide.

FAQs

Q1. What is the federal mileage rate for business in 2026?

The business mileage rate for 2026 is 72.5 cents per mile.

Q2. Did the medical mileage rate change in 2026?

No, it remains at 22 cents per mile.

Q3. Can employees use the federal mileage rate?

Only if their expenses are unreimbursed and meet eligibility rules.

Conclusion

The federal mileage rate 2026 reflects updated economic conditions and rising vehicle operating costs. With an increased business rate and stable medical, moving, and charitable rates, taxpayers have clearer guidance for calculating deductions and reimbursements. By understanding eligibility rules and maintaining accurate records, drivers can take full advantage of the 2026 federal mileage rate and manage vehicle-related expenses more effectively throughout the year.

| Federal link | Click Here |