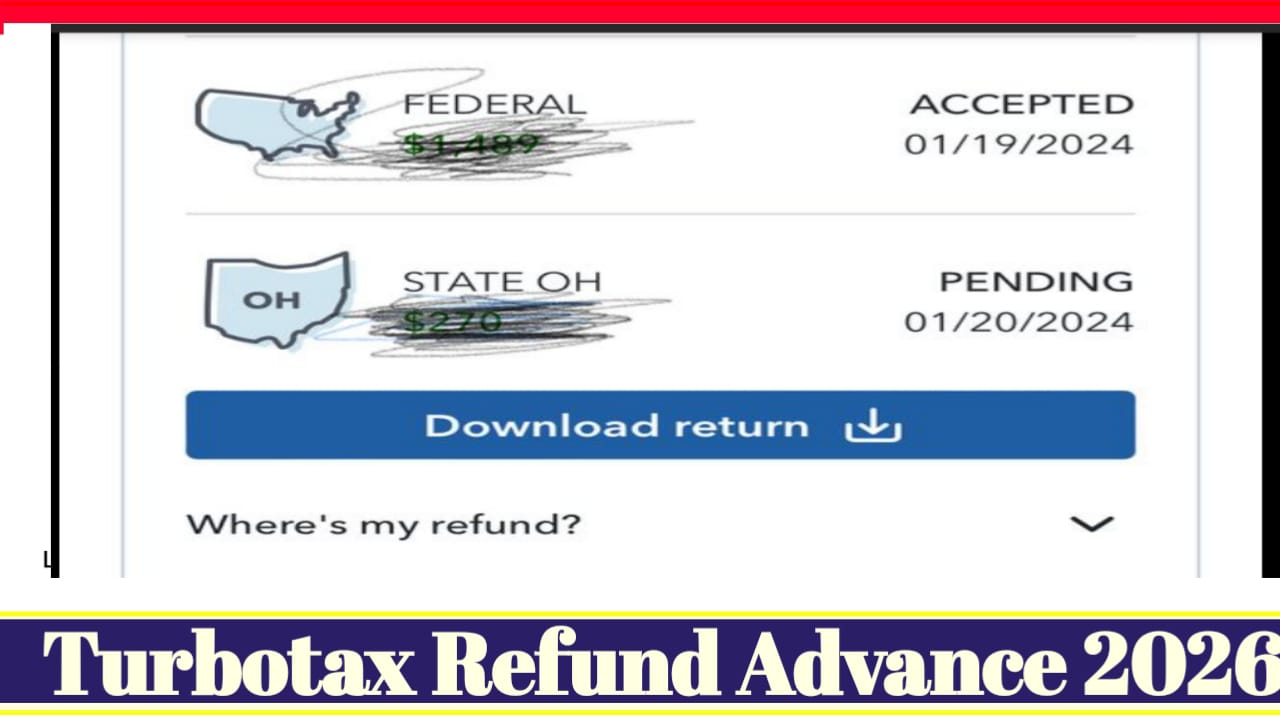

The TurboTax Refund Advance 2026 is a popular option for taxpayers who want faster access to part of their federal tax refund while waiting for the IRS to process their return. For the 2026 tax filing season, which officially begins in late January 2026 based on IRS norms, TurboTax continues to offer refund advances through its tax filing platform in partnership with a participating bank. Eligible filers may receive an advance ranging from a few hundred dollars up to several thousand dollars, depending on their expected federal refund amount. The advance is typically available within minutes of IRS acceptance, deposited to a temporary account or card provided during filing.

TurboTax Refund Advance 2026

This option is designed to help filers manage early-year expenses without waiting the usual IRS refund timeline of 21 days or longer. The TurboTax refund advance is not the full refund, but an interest-free advance that is repaid automatically once the IRS sends the actual refund.

This article explains how the TurboTax refund advance 2026 works, who qualifies, how much you can receive, and what to keep in mind before choosing this option, using the most recent confirmed information available as of January 2026.

What Is TurboTax Refund Advance 2026?

TurboTax refund advance 2026 is an optional feature available to certain TurboTax customers during the tax filing process. It allows eligible taxpayers to receive a portion of their expected federal tax refund early, without interest or loan fees.

Once the IRS accepts your return, the advance is issued quickly. When the IRS later sends the actual refund, it is used to repay the advance automatically.

How the TurboTax Refund Advance Works

The process for TurboTax refund advance 2026 follows a simple structure:

- File your federal tax return using TurboTax

- Choose the refund advance option if eligible

After IRS acceptance, the advance is issued. Repayment happens automatically when the IRS refund arrives, with no separate payment required from the filer.

TurboTax Refund Advance 2026 Amounts and Limits

The amount available depends on your expected federal refund and eligibility criteria. Below is a general overview of how refund advances typically work.

| Feature | Details |

|---|---|

| Minimum Advance | Based on refund eligibility |

| Maximum Advance | Several thousand dollars |

| Interest | None |

| Loan Fees | None |

| Credit Check | Not required |

| IRS Acceptance Required | Yes |

| Repayment Method | Automatic from refund |

| Availability | Limited-time during tax season |

READ ALSO-

Not all taxpayers qualify, even if they expect a refund.

Who Is Eligible for TurboTax Refund Advance 2026?

Eligibility depends on multiple factors, including refund amount, filing status, and IRS acceptance. Certain returns may be excluded, such as those involving complex credits or amended filings.

• You must file your federal return through TurboTax

• Your return must be accepted by the IRS

State refunds are not eligible for advances.

When Will You Receive the Refund Advance?

For TurboTax refund advance 2026, timing is a major benefit. Once the IRS accepts your return, the advance is usually issued the same day or within a short window. This is much faster than the standard IRS refund timeline.

However, acceptance timing depends on IRS processing speed, which can vary early in the tax season.

Does TurboTax Refund Advance Affect Your Refund?

The advance does not reduce your total refund. It simply provides early access to part of it. When the IRS sends the full refund, the advance amount is deducted, and the remaining balance is delivered to you based on your chosen refund method.

If the IRS reduces your refund for any reason, you may be responsible for repaying any remaining balance.

Pros and Cons of TurboTax Refund Advance 2026

Understanding the benefits and limitations helps you decide if this option is right for you.

Pros:

- Fast access to refund money

- No interest or loan fees

Cons:

- Not available to all filers

- Limited to federal refunds only

Careful review of eligibility terms during filing is essential.

Common Reasons Refund Advances Are Denied

Even eligible filers may be declined due to:

- IRS rejection or delayed acceptance

- Errors or inconsistencies on the return

- Refund amounts below minimum thresholds

Accuracy and complete information increase approval chances.

FAQs About TurboTax Refund Advance 2026

Q1. Is TurboTax refund advance a loan?

Yes, it is technically a short-term advance repaid from your refund, but it carries no interest or fees.

Q2. Can I get a refund advance on my state refund?

No. The advance applies only to eligible federal tax refunds.

Q3. What happens if my refund is delayed?

The advance is repaid when the IRS issues the refund; delays may extend repayment timing.

Conclusion

The TurboTax refund advance 2026 offers a convenient way for eligible taxpayers to access part of their federal refund much earlier than standard IRS timelines. With no interest, no loan fees, and automatic repayment, it can be a helpful financial bridge during tax season. However, eligibility is limited, and approval depends on IRS acceptance and return details. Understanding how the refund advance works allows filers to make informed decisions and avoid surprises during the 2026 tax filing season.