The 2026 mileage reimbursement rate is now officially in effect, providing updated guidance for employers, employees, and self-employed individuals who use personal vehicles for work-related travel. As confirmed in early January 2026, the federal mileage reimbursement rate applies from January 1 through December 31, 2026, and is used nationwide for tax and payroll compliance. The rate is issued annually by the Internal Revenue Service and reflects changes in fuel prices, vehicle maintenance costs, and depreciation. Employers rely on this figure to reimburse employees fairly, while workers use it to calculate non-taxable mileage compensation under accountable plans.

Mileage reimbursement plays a critical role in controlling business expenses and ensuring compliance with federal tax regulations. When employers follow the official rate, reimbursements are generally excluded from taxable income, making it beneficial for both parties.

This article explains the 2026 federal mileage reimbursement rate, how it compares to prior years, who it applies to, and how businesses and workers should use it correctly, based on the most recent verified information available.

What Is the Federal Mileage Reimbursement Rate?

The federal mileage reimbursement rate is a standard per-mile amount set annually to reflect the average cost of operating a vehicle for specific purposes. It applies primarily to business-related driving but also includes separate rates for medical, moving, and charitable travel.

Employers are not legally required to use the federal rate, but it is widely adopted because of its tax advantages and administrative simplicity.

2026 Mileage Reimbursement Rate Breakdown

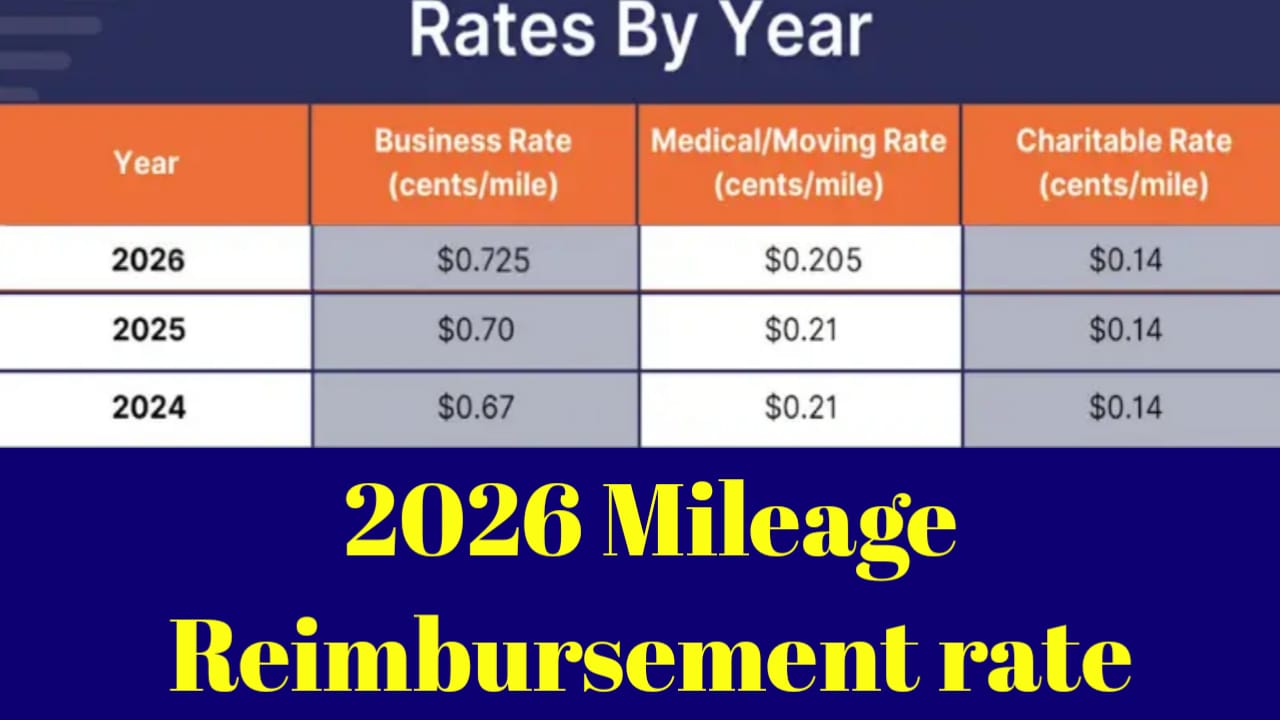

For calendar year 2026, the IRS confirmed that the standard mileage rates remain structured by purpose of travel, with business mileage carrying the highest reimbursement value.

Federal Mileage Reimbursement Rates 2026

| Travel Purpose | 2026 Rate Per Mile |

|---|---|

| Business driving | 67 cents |

| Medical travel | 22 cents |

| Moving (qualified) | 22 cents |

| Charitable service | 14 cents |

| Self-employed use | 67 cents |

| Employer reimbursement | Up to 67 cents |

| Non-accountable plans | Taxable if over rate |

| Accountable plans | Non-taxable within limits |

These rates apply only to miles driven for qualifying purposes and must be supported by proper records.

READ ALSO-

How the 2026 Mileage Rate Is Calculated

The 2026 mileage reimbursement rate reflects nationwide averages for fuel, insurance, maintenance, registration, and vehicle depreciation. The IRS reviews economic data annually before finalizing the rate.

Because fuel prices stabilized compared to earlier volatility, the 2026 rate did not see a dramatic shift, maintaining consistency for employers and workers.

Who Can Use the 2026 Mileage Reimbursement Rate?

The mileage rate is used by a wide range of individuals and organizations, including:

- Employees who drive personal vehicles for work tasks

- Self-employed individuals claiming business deductions

It applies to cars, vans, pickups, and panel trucks used for qualifying travel.

Mileage Reimbursement and Taxes in 2026

Under an accountable plan, mileage reimbursements up to the federal rate are not treated as taxable income. However, reimbursements above the official rate may be considered wages and subject to payroll taxes.

Two important tax considerations:

- Accurate mileage logs are required for compliance

- Personal commuting miles are never reimbursable

Following these rules protects both employers and employees during audits.

Employer Best Practices for Mileage Reimbursement

Businesses should clearly define mileage policies and reimbursement procedures. Using the federal rate simplifies payroll processing and reduces tax risk.

Most employers require:

- Date and purpose of travel

- Starting and ending mileage

Digital tracking tools are commonly used in 2026 to improve accuracy and documentation.

Mileage Rate vs Actual Expense Method

While the standard mileage rate is popular, some self-employed individuals may choose the actual expense method. This approach tracks real costs such as fuel, repairs, and insurance but requires more detailed recordkeeping.

Once a method is chosen for a vehicle, switching later may be restricted, so careful planning is essential.

Frequently Asked Questions

Q1. Did the mileage reimbursement rate increase in 2026?

The business rate remains at 67 cents per mile for 2026.

Q2. Is mileage reimbursement mandatory for employers?

Federal law does not require it, but some states may have specific rules.

Q3. Can I deduct mileage if my employer doesn’t reimburse me?

Most employees cannot deduct unreimbursed mileage, but self-employed individuals can.

Conclusion

The 2026 mileage reimbursement rate provides stability and clarity for work-related travel expenses. With the business rate set at 67 cents per mile, employers and workers can confidently plan reimbursements while staying compliant with tax regulations. By maintaining accurate records and following federal guidelines, mileage reimbursement remains a fair and efficient way to cover vehicle costs throughout 2026.