The 2026 mileage reimbursement rate has been officially updated, bringing important changes for employees, self-employed professionals, and businesses that rely on vehicle travel for work. For the 2026 tax year, the Internal Revenue Service has set the standard business mileage rate at 72.5 cents per mile, an increase of 2.5 cents compared to the previous year. This updated rate applies to miles driven for business purposes starting January 1, 2026. The adjustment reflects rising fuel costs, vehicle maintenance expenses, insurance, and overall transportation inflation. Millions of taxpayers who deduct vehicle expenses or receive employer reimbursements will be directly affected by this change.

2026 Mileage Reimbursement Rate Announced

Mileage reimbursement rates play a crucial role in tax deductions and expense reporting. The standard mileage rate simplifies calculations by offering a flat per-mile amount rather than tracking individual vehicle costs. For employers, it helps ensure fair compensation for employees using personal vehicles for work-related travel.

Understanding how the 2026 mileage reimbursement rate works, who qualifies, and how it is applied can help taxpayers make informed financial decisions and remain compliant with tax guidelines.

What Is the 2026 Mileage Reimbursement Rate?

The 2026 mileage reimbursement rate is the amount allowed per mile driven for approved purposes. For business travel, the rate has been increased to 72.5 cents per mile. This figure represents an all-inclusive estimate covering fuel, depreciation, repairs, insurance, and other vehicle-related costs.

The rate is reviewed annually and adjusted to reflect economic conditions and driving expenses nationwide.

Why the Mileage Rate Increased in 2026

The increase in the mileage reimbursement rate is largely driven by higher vehicle ownership and operating costs. Rising fuel prices, increased repair expenses, and insurance premiums all contributed to the updated calculation.

By raising the rate, the IRS aims to ensure that taxpayers are neither over-compensated nor under-compensated for legitimate vehicle use related to work.

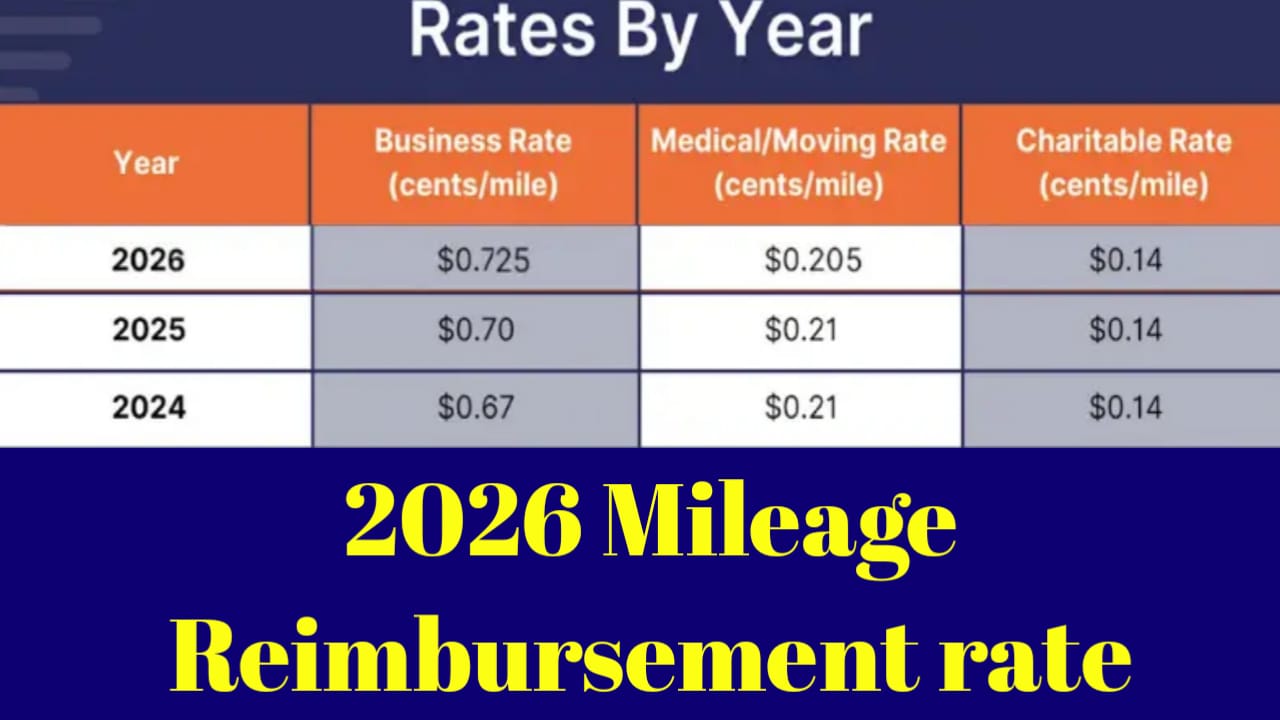

2026 Standard Mileage Rates Overview

The following table summarizes the mileage rates applicable for the 2026 tax year.

| Mileage Category | 2026 Rate (Per Mile) |

|---|---|

| Business Use | 72.5 cents |

| Medical Travel | 22 cents |

| Moving (Qualified Only) | 22 cents |

| Charitable Purposes | 14 cents |

| Rate Effective Date | January 1, 2026 |

| Applies To | Personal Vehicles |

| Calculation Method | Per Mile |

| Annual Review | Yes |

READ ALSO-

Who Can Use the 2026 Mileage Reimbursement Rate

The standard mileage rate is available to a wide range of taxpayers who use their personal vehicles for approved purposes.

Eligible users typically include:

- Self-employed individuals and freelancers

- Employees reimbursed by employers

However, certain restrictions apply, such as vehicle depreciation methods used in prior years.

Business Mileage vs Actual Expense Method

Taxpayers can generally choose between the standard mileage rate and the actual expense method. The mileage method offers simplicity, while the actual expense method may benefit those with high vehicle costs.

Once certain depreciation options are selected, switching methods later may not be allowed. Careful evaluation is recommended before choosing a method.

How Employers Use the 2026 Mileage Rate

Many employers adopt the IRS standard rate as a benchmark for employee reimbursement. While employers are not legally required to follow it, doing so helps ensure reimbursements are considered non-taxable when properly documented.

Proper mileage logs and accurate reporting remain essential for both employers and employees.

Tips to Maximize Mileage Reimbursement Benefits

Keeping accurate records is the most important step when using the mileage reimbursement rate.

- Track miles consistently throughout the year

- Separate personal and business travel clearly

Good documentation reduces audit risk and ensures correct reimbursement or deductions.

FAQs – 2026 Mileage Reimbursement Rate

Q1. What is the business mileage rate for 2026?

The business mileage rate for 2026 is 72.5 cents per mile.

Q2. When does the 2026 mileage rate take effect?

The rate applies to miles driven starting January 1, 2026.

Q3. Can employees use the mileage rate for tax deductions?

Employees generally rely on employer reimbursement, while self-employed individuals can deduct mileage directly if eligible.

Conclusion

The 2026 mileage reimbursement rate marks a meaningful increase that reflects the rising cost of driving for work-related purposes. With the business rate set at 72.5 cents per mile, taxpayers and employers alike have a clear benchmark for reimbursement and deductions in the new tax year. By understanding eligibility rules, maintaining accurate mileage records, and choosing the right deduction method, individuals can fully benefit from the updated rate while staying compliant. As driving expenses continue to evolve, staying informed about mileage rate changes remains essential for smart financial planning.