The 2026 mileage reimbursement rate PDF released by the Internal Revenue Service provides updated guidance for businesses, employees, and self-employed individuals who use their personal vehicles for work purposes. Each year, the IRS reviews transportation costs, fuel prices, and vehicle maintenance trends before adjusting the standard mileage rates. For 2026, the updated figures apply to business travel, medical trips, moving purposes for qualified individuals, and charitable services. These rates help determine how much taxpayers can deduct or be reimbursed per mile driven. Employers often rely on the official mileage notice to structure reimbursement policies, ensuring compliance with federal guidelines while maintaining accurate expense tracking and financial reporting practices.

2026 Mileage Reimbursement Rate PDF

The annual mileage adjustment reflects real-world economic conditions. Rising fuel prices, insurance costs, and maintenance expenses influence how the reimbursement rate is calculated. The goal is to create a fair standard that represents the average cost of operating a vehicle for work-related purposes.

Understanding the 2026 mileage reimbursement update is important for anyone who logs miles for professional or qualified personal reasons. Clear knowledge of the guidelines helps avoid reporting errors and ensures proper reimbursement or deductions.

What Is the 2026 Mileage Reimbursement Rate

The mileage reimbursement rate is the amount taxpayers can claim per mile when using their personal vehicle for approved purposes. The IRS sets these rates annually to simplify recordkeeping and ensure fairness.

The 2026 update includes revised per-mile amounts for different travel categories. These rates apply throughout the calendar year unless otherwise announced.

Categories Covered Under the 2026 Mileage Rates

The mileage reimbursement guidelines cover several types of travel, each with its own applicable rate depending on the purpose of the trip.

| Travel Category | Description | Applies To | Purpose | Recordkeeping Needed | Deduction Eligible | Employer Reimbursement | IRS Approval Basis |

|---|---|---|---|---|---|---|---|

| Business Travel | Work-related driving | Employees/Self-employed | Meetings, site visits | Yes | Yes | Yes | Operating costs |

| Medical Travel | Health-related trips | Individuals | Doctor visits | Yes | Yes | Sometimes | Medical necessity |

| Moving Purposes | Qualified relocations | Eligible taxpayers | Job-related move | Yes | Conditional | No | Eligibility criteria |

| Charitable Service | Volunteer work | Volunteers | Nonprofit service | Yes | Yes | No | Federal guidelines |

| Temporary Assignments | Short-term work travel | Employees | Field assignments | Yes | Yes | Yes | Employer verification |

| Client Visits | Sales/service trips | Professionals | Client meetings | Yes | Yes | Yes | Expense tracking |

| Training Programs | Education travel | Employees | Skill development | Yes | Sometimes | Yes | Employer approval |

| Government Duties | Official tasks | Public sector | Agency assignments | Yes | Yes | Yes | Federal policy |

READ ALSO-

Why the IRS Updates Mileage Rates Every Year

Mileage reimbursement rates change annually to reflect shifts in fuel prices, maintenance costs, insurance premiums, and overall vehicle ownership expenses. These adjustments ensure that reimbursements remain fair and realistic.

The IRS evaluates national economic data before announcing each year’s update. This process helps maintain consistency and transparency in reimbursement practices.

Who Benefits From the 2026 Mileage Reimbursement Rate

The updated mileage rate benefits employees, self-employed professionals, nonprofit volunteers, and businesses. Employers often adopt the IRS rate to simplify payroll processing and expense claims.

• Employees receive fair compensation for work-related vehicle use

• Businesses gain standardized expense tracking for budgeting

These advantages promote transparency and financial accuracy.

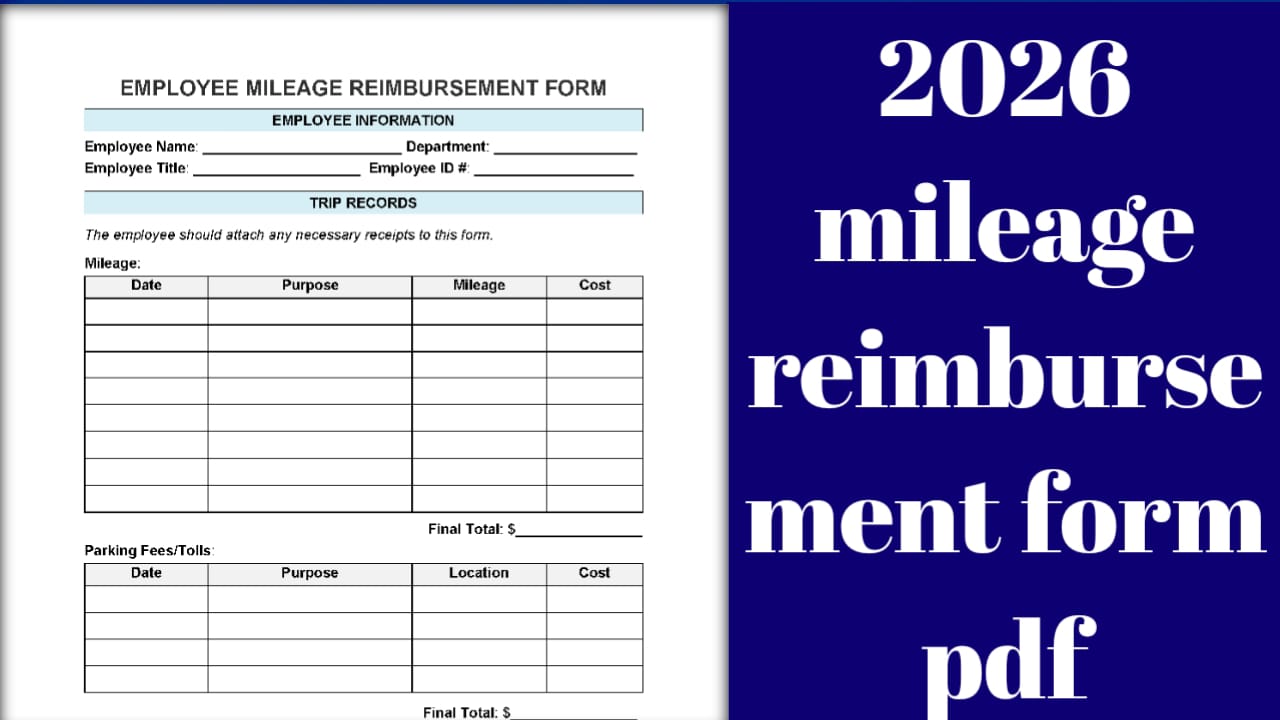

How to Track Mileage for Reimbursement

Accurate mileage tracking is essential for claiming deductions or reimbursements. Taxpayers should maintain logs that include travel dates, destinations, purpose, and total miles driven.

Digital tracking tools and manual logs are both acceptable methods, provided the information is detailed and consistent.

Common Mistakes to Avoid When Claiming Mileage

Many individuals make errors when calculating mileage deductions. These mistakes can lead to incorrect tax filings or denied reimbursements.

For example, commuting miles between home and a regular workplace are generally not deductible. Only qualified trips count under IRS rules.

Employer Guidelines for Mileage Reimbursement in 2026

Employers often use the IRS mileage rate as a benchmark for reimbursing employees. This ensures fairness while simplifying accounting procedures.

Clear reimbursement policies help avoid disputes and ensure accurate payroll records.

Importance of the 2026 Mileage Reimbursement Rate PDF

The official mileage rate document provides clarity on updated figures and rules. Businesses and individuals rely on it to maintain compliance with federal standards.

Staying informed helps taxpayers avoid outdated claims and ensures accurate financial reporting.

FAQs About 2026 Mileage Reimbursement Rate

1. Who sets the 2026 mileage reimbursement rate?

The IRS determines the standard mileage rate each year based on vehicle operating costs.

2. Can employers set their own mileage rates?

Yes, but many choose the IRS rate for consistency and compliance.

3. Are commuting miles deductible?

No, regular commuting between home and work is generally not eligible.

Conclusion

The 2026 mileage reimbursement rate PDF plays a crucial role in helping businesses and individuals calculate travel expenses accurately. By adjusting rates annually, the IRS ensures reimbursements reflect real economic conditions while maintaining fairness. Employees, self-employed professionals, and employers all benefit from understanding updated guidelines. Proper mileage tracking, awareness of eligible travel categories, and adherence to official standards help avoid errors and financial discrepancies. Staying informed about annual mileage updates supports better financial planning, transparent reimbursement processes, and compliance with federal regulations.