The backdoor Roth limit 2026 is a key topic for high-income earners who want access to tax-free retirement growth despite Roth IRA income restrictions. As of January 2026, the Internal Revenue Service has not announced a special or separate dollar cap for backdoor Roth contributions. Instead, the backdoor Roth follows standard IRA contribution limits set annually by the IRS and published on its official tax guidance platform. For reference, the most recently confirmed IRA contribution limits are 7,000 dollars per year, or 8,000 dollars for individuals aged 50 and older. Contributions for a given tax year can typically be made until the federal tax filing deadline in April of the following year.

Backdoor Roth Limit 2026

Understanding how the backdoor Roth IRA works is critical in 2026 because income limits continue to restrict direct Roth IRA contributions for many taxpayers. The backdoor strategy remains legal and widely used, allowing eligible individuals to convert after-tax traditional IRA contributions into Roth IRA funds. This article explains the backdoor Roth limit 2026 using the most up-to-date confirmed rules and guidance.

This guide focuses on contribution limits, income thresholds, tax implications, and planning considerations, while avoiding outdated assumptions or unnecessary complexity.

What Is a Backdoor Roth IRA?

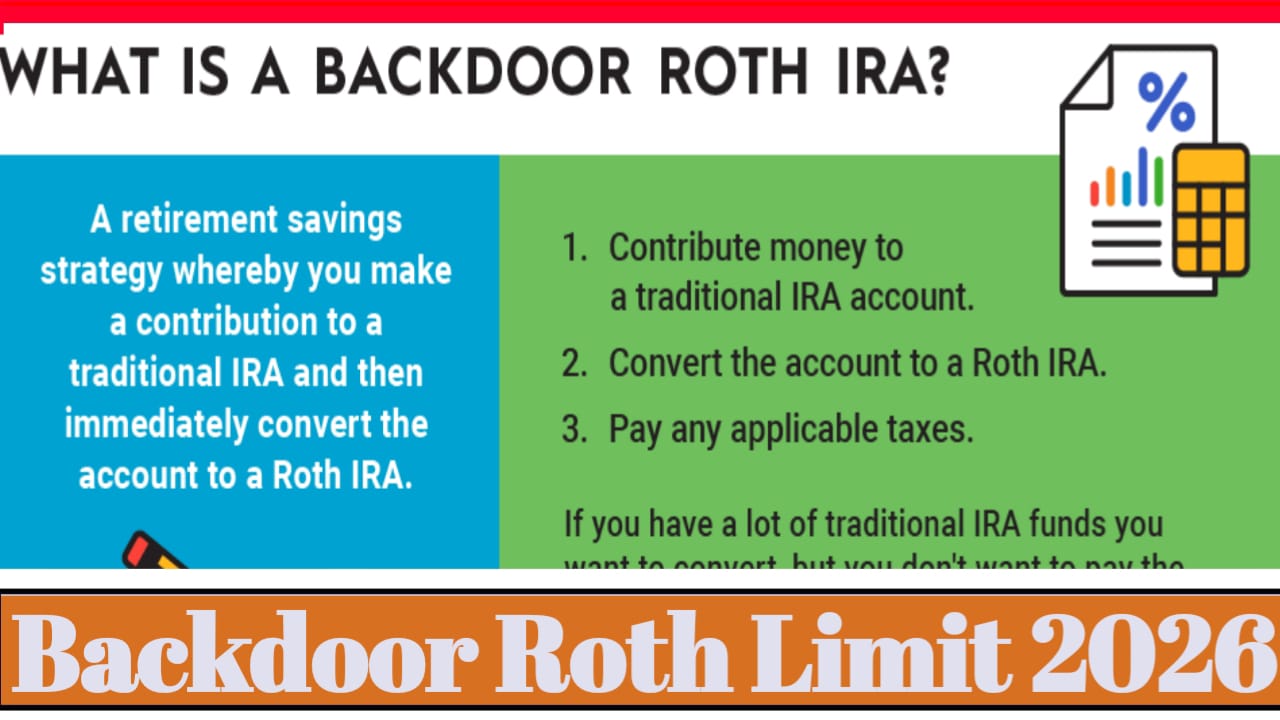

A backdoor Roth IRA is not a separate retirement account type. It is a legal, IRS-recognized strategy that involves making a non-deductible contribution to a traditional IRA and then converting that amount to a Roth IRA. This approach bypasses Roth IRA income limits without violating contribution rules.

The backdoor Roth limit 2026 is governed entirely by standard IRA contribution limits, not by income.

Backdoor Roth Limit 2026 Explained

For 2026, the backdoor Roth IRA contribution amount is limited to the annual IRA contribution cap set by the IRS. There is no additional or higher limit for using the backdoor method.

Below is a summary table outlining the applicable limits and rules.

| Category | 2026 Rule |

|---|---|

| Annual IRA Contribution Limit | 7,000 dollars |

| Catch-Up Contribution (Age 50+) | 8,000 dollars |

| Roth IRA Income Limit | Applies to direct contributions only |

| Income Limit for Backdoor Roth | None |

| Contribution Deadline | Tax filing deadline (April 2027) |

| Conversion Limit | No dollar cap |

| Tax on Conversion | Depends on pre-tax IRA balances |

| Strategy Legality | Allowed under current tax law |

READ ALSO-

These limits apply per individual, not per household.

Roth IRA Income Limits vs Backdoor Roth Strategy

Roth IRA income limits restrict who can contribute directly to a Roth IRA. In contrast, the backdoor Roth limit 2026 does not depend on income level.

High earners who exceed Roth income thresholds can still:

• Contribute to a traditional IRA using after-tax dollars

• Convert those funds to a Roth IRA

This distinction makes the backdoor Roth especially valuable for professionals and business owners with rising incomes.

How Taxes Apply to a Backdoor Roth in 2026

Taxes are a critical factor in backdoor Roth planning. While the contribution itself is after-tax, the conversion may trigger taxes if you hold other pre-tax IRA funds.

This is due to the IRS pro-rata rule, which requires all traditional IRA balances to be considered when calculating taxable conversions. The backdoor Roth limit 2026 does not override this rule.

Careful coordination is often needed if you already have rollover or deductible IRA balances.

Step-by-Step Backdoor Roth Process

The process remains unchanged for 2026:

- Make a non-deductible contribution to a traditional IRA

- Convert the contribution to a Roth IRA

Timing matters. Many investors convert shortly after contributing to minimize taxable growth between steps.

Is the Backdoor Roth Still Allowed in 2026?

Yes. As of the current tax year, Congress has not eliminated or restricted the backdoor Roth strategy. Despite discussions in past legislative proposals, the backdoor Roth remains legal and widely used.

The backdoor Roth limit 2026 follows existing IRA rules unless future tax law changes occur.

Who Should Consider a Backdoor Roth IRA?

This strategy is best suited for:

- High-income earners exceeding Roth IRA income limits

- Individuals seeking tax-free retirement withdrawals

- Savers who have maximized employer retirement plans

Those with large pre-tax IRA balances should evaluate tax impact carefully.

FAQs About Backdoor Roth Limit 2026

Q1. Is there a special backdoor Roth limit for 2026?

No. The limit is the standard IRA contribution limit set by the IRS.

Q2. Can I do a backdoor Roth if I earn too much for a Roth IRA?

Yes. Income limits do not apply to backdoor Roth conversions.

Q3. Are backdoor Roth conversions taxable?

They can be, depending on existing pre-tax IRA balances.

Conclusion

The backdoor Roth limit 2026 remains straightforward and consistent with prior years. There is no unique cap or special allowance beyond the standard IRA contribution limits. As long as current tax law remains unchanged, high-income earners can continue using the backdoor Roth strategy to build tax-free retirement savings. Understanding contribution limits, tax rules, and proper timing is essential for making the most of this powerful retirement planning tool in 2026.