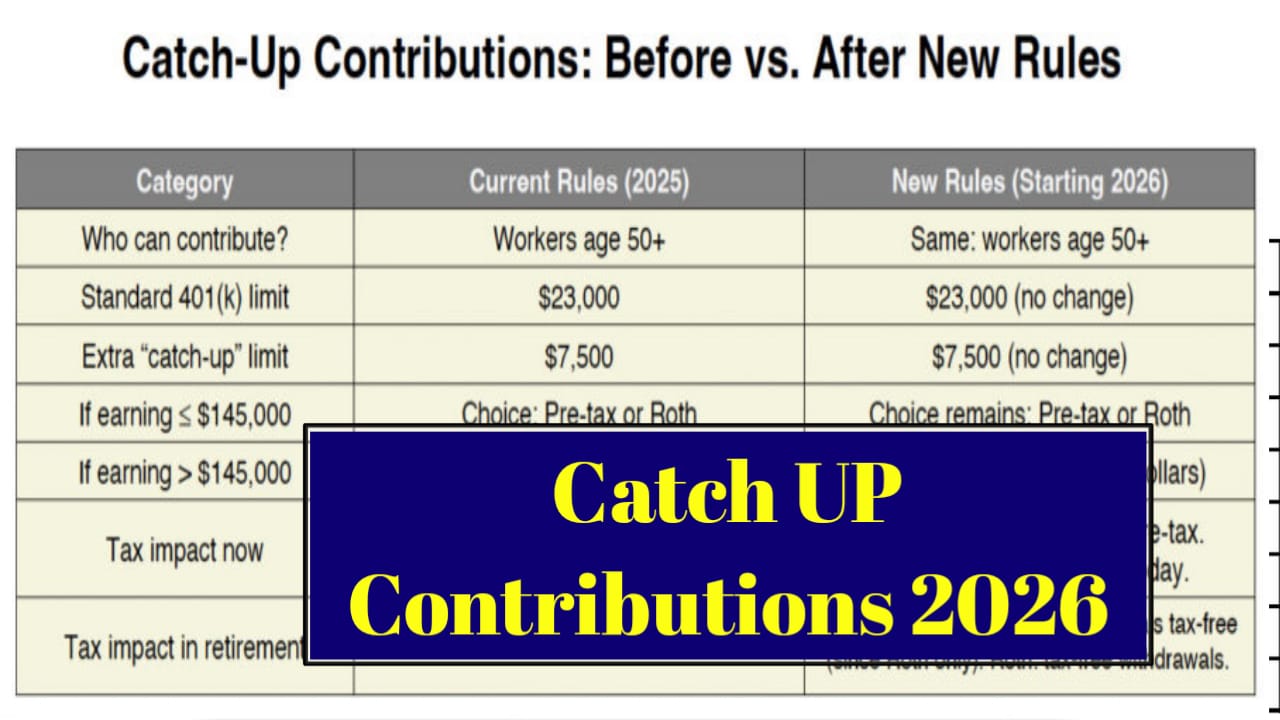

Catch up contributions 2026 bring major changes for retirement savers aged 50 and above, especially due to updates under the SECURE 2.0 Act. Starting in 2026, higher-income workers who make catch up contributions to employer-sponsored retirement plans will be required to treat those contributions as Roth (after-tax) instead of traditional pre-tax. These rules apply to plans such as 401(k), 403(b), and similar workplace accounts. The changes officially take effect in January 2026 and are administered under federal retirement regulations. Income thresholds, age brackets, and contribution limits are clearly defined, making it essential for savers to understand how much they can contribute and how taxes will apply going forward.

Catch Up Contributions 2026

The goal of the new catch up contribution rules is to increase long-term tax transparency while encouraging older workers to boost retirement savings later in their careers.

This article explains catch up contributions 2026, including eligibility, limits, Roth requirements, and practical planning tips using the most recent confirmed information.

What Are Catch Up Contributions

Catch up contributions allow individuals aged 50 or older to contribute additional amounts beyond standard retirement plan limits. These extra contributions help late-career workers strengthen retirement savings as they approach retirement age.

Key Changes to Catch Up Contributions in 2026

The most significant update in 2026 is the mandatory Roth treatment for certain catch up contributions. Employees earning above a specific income threshold must make their catch up contributions as Roth contributions, meaning they are taxed upfront but withdrawn tax-free later.

Catch Up Contributions 2026 Overview Table

| Feature | Details |

|---|---|

| Minimum Age | 50 years |

| Special Age Group | 60 to 63 years |

| Income Threshold | Over defined annual wage limit |

| Roth Requirement | Mandatory for higher earners |

| Applies To | 401(k), 403(b), similar plans |

| Tax Treatment | After-tax for required Roth |

| Effective Year | 2026 |

| Purpose | Boost late-career retirement savings |

READ ALSO-

Roth Catch Up Contribution Rule Explained

Under the 2026 rules, workers whose wages exceed the specified income level must make catch up contributions as Roth contributions. This means no immediate tax deduction, but qualified withdrawals in retirement are tax-free.

Lower-income workers may still be allowed to choose between traditional and Roth catch up contributions, depending on employer plan design.

Higher Catch Up Limits for Ages 60 to 63

Another important feature of catch up contributions 2026 is the increased limit for individuals aged 60 through 63. This special age group is permitted to contribute more than the standard catch up amount, allowing for accelerated retirement savings during peak earning years.

Which Retirement Plans Are Affected

Most employer-sponsored plans are covered under the new rules, including workplace retirement accounts commonly used by private-sector and nonprofit employees. Individual retirement accounts follow different contribution rules and are not subject to mandatory Roth catch up requirements.

Tax Impact of Catch Up Contributions in 2026

Because Roth catch up contributions are taxed upfront, they may increase taxable income in the contribution year. However, they also reduce future tax exposure during retirement.

- Roth contributions offer tax-free withdrawals in retirement

- Traditional contributions may still be available for eligible lower earners

Planning Tips for Catch Up Contributions 2026

Proper planning is essential to make the most of the new rules. Reviewing income levels, understanding tax brackets, and coordinating contributions with long-term retirement goals can help maximize benefits.

Common Mistakes to Avoid

Some savers assume all catch up contributions are still pre-tax, which may lead to unexpected tax bills. Others fail to adjust payroll settings in time, missing out on allowed contribution amounts.

Frequently Asked Questions (FAQs)

Q1: Are catch up contributions mandatory in 2026?

No, they are optional, but Roth treatment is mandatory for certain higher earners.

Q2: Who must use Roth catch up contributions?

Workers above the defined income threshold making catch up contributions in employer plans.

Q3: Do IRAs follow the same catch up rules?

No, IRA catch up contributions are not affected by the mandatory Roth requirement.

Conclusion

Catch up contributions 2026 represent one of the most meaningful retirement policy shifts in recent years. With mandatory Roth treatment for higher earners and increased limits for those aged 60 to 63, savers must rethink how they approach late-career retirement planning. Understanding eligibility, tax treatment, and contribution limits will help individuals make informed decisions and avoid costly mistakes. With proper planning, the new rules can become a powerful tool for building long-term financial security.