The IRS estimated tax payment 2026 schedule is critical for self-employed individuals, freelancers, investors, and others who do not have enough tax withheld from regular paychecks. Estimated taxes are paid quarterly to cover federal income tax, self-employment tax, and other applicable liabilities. For the 2026 tax year, the standard IRS payment deadlines are April 15, June 15, and September 15, 2026, with the final payment due January 15, 2027. These dates and rules are set by the Internal Revenue Service and published on the official IRS website as part of its annual tax guidance.

Estimated tax payments help taxpayers avoid large year-end balances and penalties. The system ensures taxes are paid throughout the year as income is earned, not just when a return is filed.

This guide explains everything you need to know about IRS estimated tax payment 2026, including who must pay, due dates, calculation methods, and common mistakes to avoid, using the most recent verified IRS guidance.

What Is an IRS Estimated Tax Payment?

An estimated tax payment is a quarterly payment made to the IRS when taxes are not automatically withheld from income. This typically applies to income from self-employment, interest, dividends, rental property, or freelance work.

You may need to make estimated payments if you expect to owe at least a minimum amount in federal tax after subtracting withholding and credits.

IRS Estimated Tax Payment Dates for 2026

The IRS divides the tax year into four payment periods. Each period has a fixed due date, even though they are not evenly spaced.

| Payment Period | Income Covered | Due Date | Tax Year |

|---|---|---|---|

| First Quarter | Jan 1 – Mar 31 | April 15, 2026 | 2026 |

| Second Quarter | Apr 1 – May 31 | June 15, 2026 | 2026 |

| Third Quarter | Jun 1 – Aug 31 | September 15, 2026 | 2026 |

| Fourth Quarter | Sep 1 – Dec 31 | January 15, 2027 | 2026 |

| Payment Frequency | Quarterly | Fixed | IRS standard |

| Applies To | Individuals & businesses | — | Federal tax |

| Penalty Risk | Yes, if late | — | IRS rules |

| Filing Method | Electronic or mail | — | IRS approved |

READ ALSO-

Who Needs to Make Estimated Tax Payments in 2026

Not everyone is required to make estimated payments. However, many taxpayers fall into this category.

You likely need to pay estimated taxes in 2026 if:

- You are self-employed or run a small business

- You earn income not subject to withholding

This includes gig workers, independent contractors, and individuals with significant investment income.

How to Calculate IRS Estimated Tax for 2026

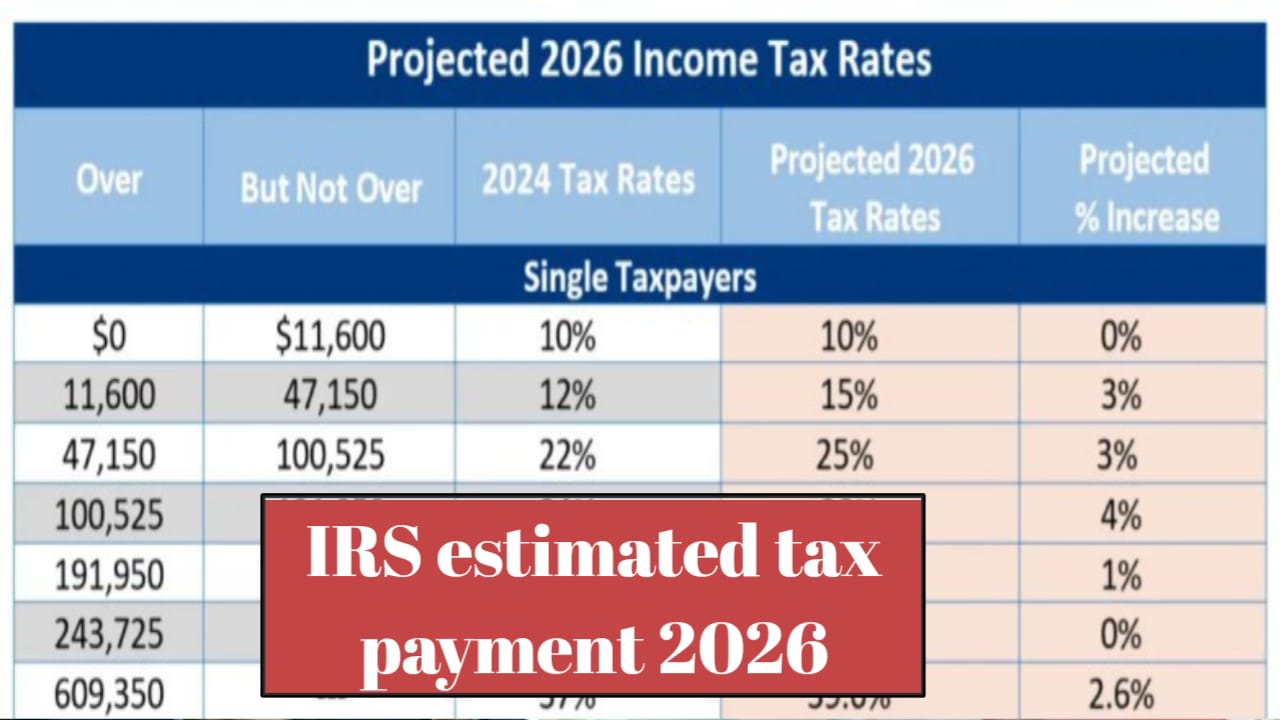

Estimated taxes are based on your expected annual income, deductions, and credits. Many taxpayers use the prior year’s tax return as a starting point.

Common calculation methods include:

- Paying 100 percent of last year’s tax liability

- Estimating current-year income and applying current tax rates

Accuracy is important to avoid underpayment penalties.

How to Pay IRS Estimated Taxes

The IRS offers multiple payment options for estimated taxes. Electronic payments are generally faster and easier to track.

Payment methods include:

- Online payments using a bank account

- Mailing a payment voucher with a check

Always ensure payments are credited to the correct tax year and quarter.

Penalties for Missing Estimated Tax Payments

Failing to make IRS estimated tax payments 2026 on time can result in penalties and interest. Penalties apply even if you receive a refund when you file your return.

Reasons penalties may apply:

- Payments were late or skipped

- Payments were too small for the income earned

Tips to Stay Compliant With Estimated Taxes in 2026

Staying organized throughout the year reduces stress and financial surprises. Many taxpayers set reminders or use accounting tools to track income and payments.

Regularly reviewing income changes can help adjust estimated payments before deadlines.

Frequently Asked Questions (FAQs)

Q1. What are the IRS estimated tax payment dates for 2026?

They are April 15, June 15, September 15, 2026, and January 15, 2027.

Q2. Do I need to pay estimated taxes if I have a regular job?

Only if your withholding does not cover enough of your total tax liability.

Q3. Can I pay more than required in one quarter?

Yes, overpaying is allowed and can reduce future payment obligations.

Conclusion

The IRS estimated tax payment 2026 system is designed to keep taxpayers current on their federal tax obligations throughout the year. By understanding who must pay, following the quarterly due dates, and calculating payments accurately, individuals can avoid penalties and manage cash flow more effectively. Staying informed and proactive ensures compliance and peace of mind when tax season arrives.

| Payment link | Click Here |

| Official Webs | Click Here |