The IRS Tax Refund 2026 schedule gives taxpayers an estimated timeline for receiving refunds for 2025 federal income tax returns. According to the latest update, the Internal Revenue Service is expected to begin accepting electronically filed tax returns from January 26, 2026. Most taxpayers who file electronically and choose direct deposit may receive their refunds within 10 to 21 business days, depending on processing time and return accuracy. Millions of refunds will be issued during the 2026 tax season, making it essential for taxpayers to understand refund timelines, delays, and eligibility conditions.

IRS Tax Refund 2026 Schedule

The IRS continues to prioritize electronic filing and direct deposit to speed up refund processing. Paper-filed returns usually take longer to process, which may result in delayed refunds. Taxpayers claiming refundable credits such as the Earned Income Tax Credit or Additional Child Tax Credit should expect longer processing times due to mandatory verification rules.

Knowing the IRS refund schedule for 2026 helps taxpayers plan expenses, manage cash flow, and avoid unnecessary anxiety during tax season. Filing early and accurately remains the best way to receive a refund as quickly as possible.

IRS Tax Refund 2026 Overview

The refund timeline is influenced by filing method, credits claimed, and IRS verification procedures. Most refunds are issued on a rolling basis once returns are accepted and approved.

Key Highlights of the 2026 Refund Cycle

- Electronic filing opens in late January 2026

- Direct deposit refunds are generally the fastest

- Credit-related refunds may be delayed until March

- Errors or mismatches can slow down processing

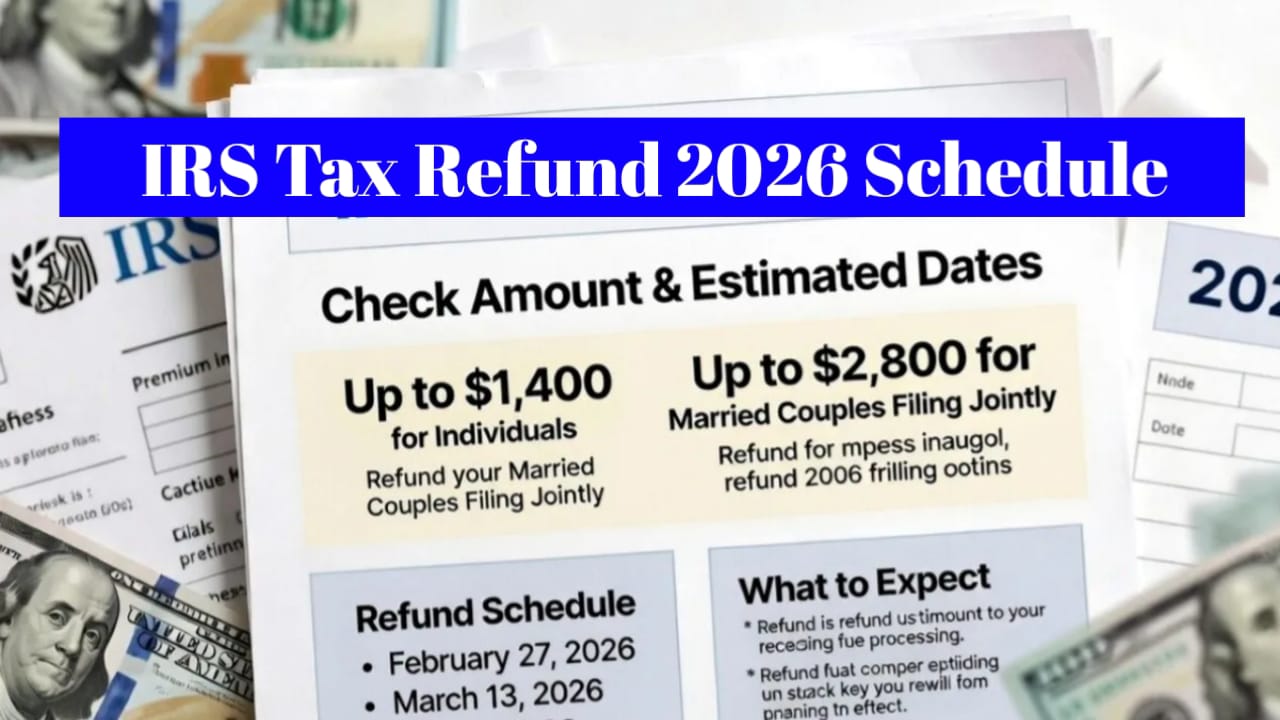

Estimated IRS Tax Refund 2026 Schedule

The table below shows estimated refund dates based on when the IRS accepts a tax return. These dates apply primarily to e-filed returns with direct deposit.

| IRS Acceptance Date | Expected Refund Date |

|---|---|

| January 26, 2026 | February 6, 2026 |

| February 2, 2026 | February 13, 2026 |

| February 9, 2026 | February 20, 2026 |

| February 16, 2026 | February 27, 2026 |

| February 23, 2026 | March 6, 2026 |

| March 2, 2026 | March 13, 2026 |

| March 9, 2026 | March 20, 2026 |

| March 16, 2026 | March 27, 2026 |

These dates are estimates and may vary depending on IRS processing workload and return accuracy.

ALSO READ-

Why Some IRS Refunds Are Delayed

Not all refunds are issued at the same speed. Certain conditions require additional IRS review before a refund can be released.

Common Reasons for Refund Delays

- Claiming Earned Income Tax Credit or Additional Child Tax Credit

- Errors in personal or banking information

- Missing or mismatched income details

- Identity verification requirements

Federal law requires the IRS to hold refunds that include specific credits until verification checks are completed, which typically pushes refunds into early March.

How to Get Your IRS Refund Faster

Taxpayers can reduce delays by following a few best practices during filing.

- File electronically instead of using paper forms

- Double-check income, deductions, and bank details

These steps significantly reduce the chances of processing errors and refund holds.

Direct Deposit vs Paper Refunds

Direct deposit remains the fastest and safest way to receive a tax refund in 2026. Paper checks take longer due to mailing and manual processing.

Direct deposit advantages include:

- Faster access to funds

- Reduced risk of lost or stolen checks

- Immediate transfer once approved

Taxpayers who choose direct deposit generally receive refunds days earlier than those who request paper checks.

IRS Refund Processing Time in 2026

Most taxpayers can expect refunds within 10 to 21 business days after IRS acceptance. However, returns requiring additional review may take longer. Filing early in the season often results in faster processing due to lower system load.

Refunds continue to be issued weekly throughout the filing season, including after the April tax deadline.

FAQs – IRS Tax Refund 2026 Schedule

Q1. When will the IRS start accepting tax returns in 2026?

The IRS is expected to begin accepting electronic tax returns on January 26, 2026.

Q2. How long does it take to receive a refund after filing?

Most electronic filers receive refunds within 10 to 21 business days, provided there are no errors or credit-related holds.

Q3. Why are refunds with tax credits delayed?

Refunds that include certain refundable credits are delayed due to federal verification requirements to prevent fraud.

Conclusion

The IRS Tax Refund 2026 schedule provides a helpful roadmap for taxpayers planning their finances during tax season. With electronic filing starting in late January and most refunds issued within a few weeks, taxpayers who file early and accurately can expect faster results. Refunds involving tax credits may take longer, but understanding the process helps set realistic expectations. Choosing electronic filing and direct deposit remains the most reliable way to receive an IRS tax refund quickly in 2026.

| IRS Refund | Click Here |

| Official Website | Click Here |