The mileage rate 2026 is officially in effect from January 1, 2026, bringing updated reimbursement figures that affect millions of employees, self-employed workers, and businesses across the United States. The Internal Revenue Service announced an increase in the standard mileage rate for business use, reflecting higher vehicle operating costs. For 2026, the business mileage rate is 68.5 cents per mile, while medical and moving mileage is 22 cents per mile, and the charitable mileage rate remains 14 cents per mile, unchanged by law. These rates apply for the entire 2026 tax year and are used for tax deductions and employer reimbursement calculations.

Mileage Rate 2026 Explained

Mileage rates are reviewed annually and are based on fuel prices, maintenance, insurance, and depreciation trends. The 2026 adjustment continues the IRS trend of aligning reimbursement more closely with real-world driving costs. Whether you are filing taxes, managing payroll, or tracking expenses, understanding the updated mileage rate is essential.

This guide explains the IRS mileage rate 2026, who can use it, how it applies to reimbursements, and what has changed compared to prior years—using only verified, up-to-date information.

What Is the IRS Mileage Rate for 2026?

The IRS mileage rate 2026 sets the maximum per-mile amount taxpayers and employers can use to calculate deductible or reimbursable vehicle expenses. Instead of tracking every fuel or repair receipt, drivers can use this simplified standard rate.

The 2026 increase mainly impacts business mileage, acknowledging rising operating costs for vehicles used for work purposes.

Official IRS Mileage Rates for 2026

The IRS has confirmed the following standard mileage rates effective January 1, 2026:

| Mileage Category | 2026 Rate (per mile) |

|---|---|

| Business use of a vehicle | 68.5 cents |

| Medical travel | 22 cents |

| Moving (qualified active-duty military only) | 22 cents |

| Charitable service | 14 cents |

| Effective start date | January 1, 2026 |

| Mid-year adjustment | None announced |

| Applies to cars, vans, pickups | Yes |

| Optional actual expense method | Allowed |

ALSO READ-

Why the Mileage Rate Increased in 2026

The mileage rate increase for 2026 reflects:

- Higher fuel and maintenance costs

- Increased insurance and vehicle ownership expenses

The IRS evaluates national cost data annually to ensure reimbursement rates remain realistic for taxpayers using personal vehicles for work or approved purposes.

Who Can Use the Mileage Rate 2026?

The standard mileage rate can be used by:

- Self-employed individuals and freelancers

- Employees receiving employer mileage reimbursement

- Businesses calculating deductible vehicle expenses

Two key reminders:

- You must own or lease the vehicle

- You cannot switch to the standard rate if depreciation rules were restricted in earlier years

Mileage Rate 2026 for Employers and Employees

Employers may reimburse workers up to the IRS mileage rate 2026 without the payment being treated as taxable income, as long as proper records are kept. Employees should log:

- Date of travel

- Business purpose

- Total miles driven

Accurate mileage tracking protects both employers and employees during audits.

Business vs Medical vs Charitable Mileage in 2026

Not all mileage is treated the same. Business mileage receives the highest reimbursement rate due to broader cost factors. Medical and military moving rates are lower and adjusted differently, while charitable mileage is fixed by statute and does not change annually.

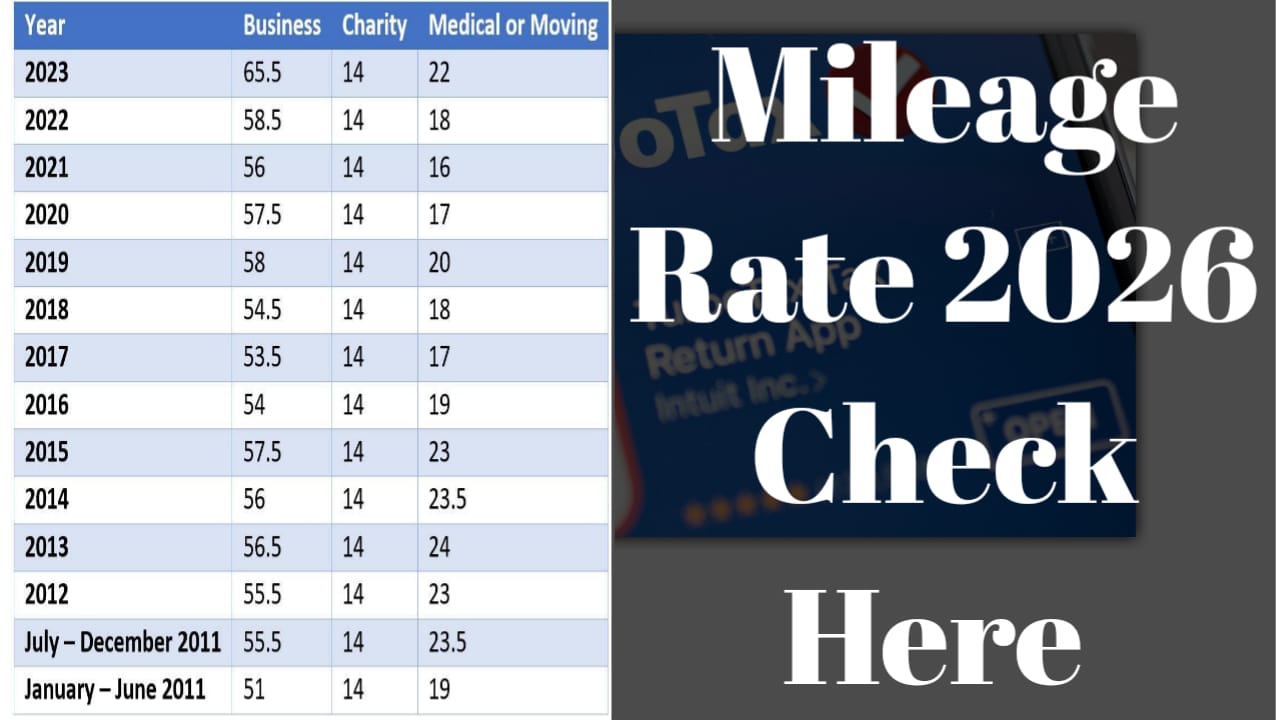

Mileage Rate 2026 Compared to Previous Years

The 2026 business mileage rate represents a continued upward adjustment compared to earlier years, signaling sustained increases in vehicle operating costs. This trend benefits taxpayers who rely heavily on personal vehicles for work-related travel.

FAQs About Mileage Rate 2026

Q1. What is the IRS mileage rate for business use in 2026?

The business mileage rate for 2026 is 68.5 cents per mile.

Q2. Does the mileage rate apply to all vehicles?

Yes, it applies to cars, vans, pickups, and panel trucks used for qualified purposes.

Q3. Can I still use actual vehicle expenses instead of the mileage rate?

Yes, if you meet IRS eligibility rules, you may choose the actual expense method.

Conclusion

The mileage rate 2026 brings a meaningful increase for business drivers, offering better compensation for rising vehicle costs. With a 68.5-cent business rate, updated medical and moving allowances, and unchanged charitable mileage, the IRS has set clear standards for the 2026 tax year. Whether you are an employer, contractor, or taxpayer, understanding and correctly applying these rates can help you stay compliant and maximize allowable deductions. Keeping accurate mileage records remains essential to fully benefit from the updated 2026 mileage rules.