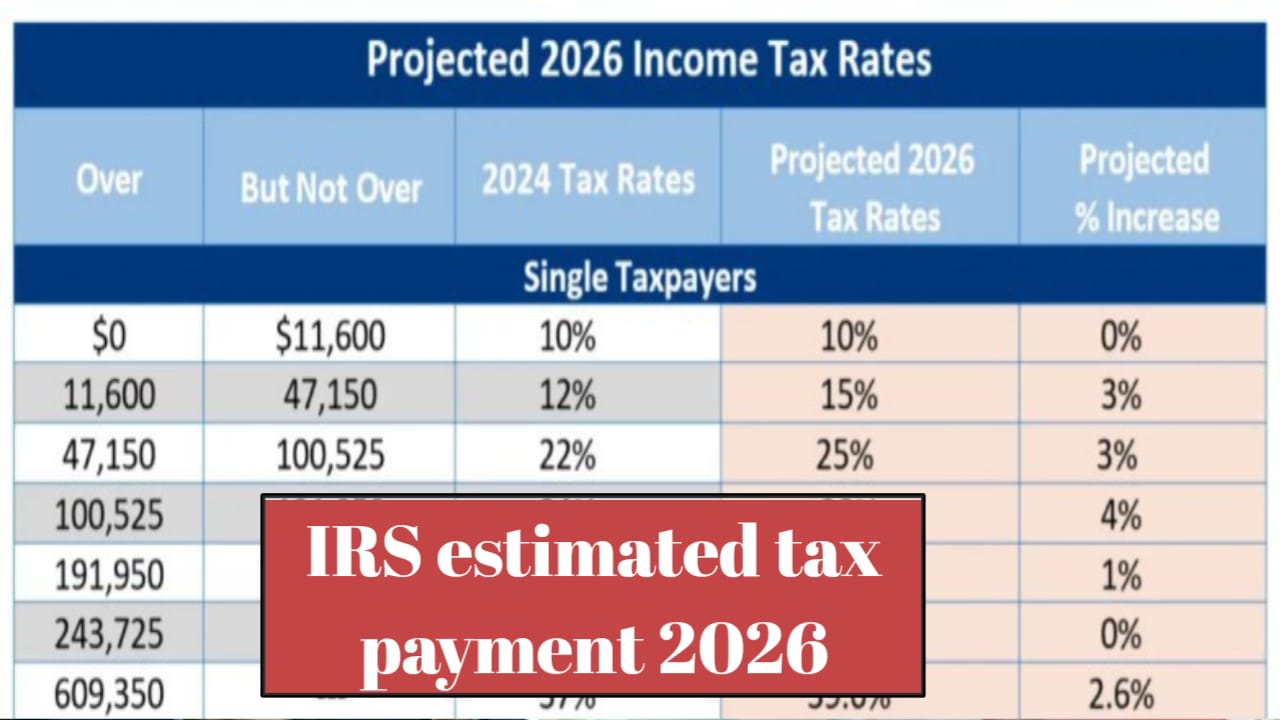

IRS Estimated Tax Payment 2026: Key Deadlines, Rules, and How to Pay on Time

The IRS estimated tax payment 2026 schedule is critical for self-employed individuals, freelancers, investors, and others who do not have enough tax withheld from regular paychecks. Estimated taxes are paid quarterly to cover federal income tax, self-employment tax, and other applicable liabilities. For the 2026 tax year, the standard IRS payment deadlines are April 15, … Read more